- Empty cart.

- Continue Shopping

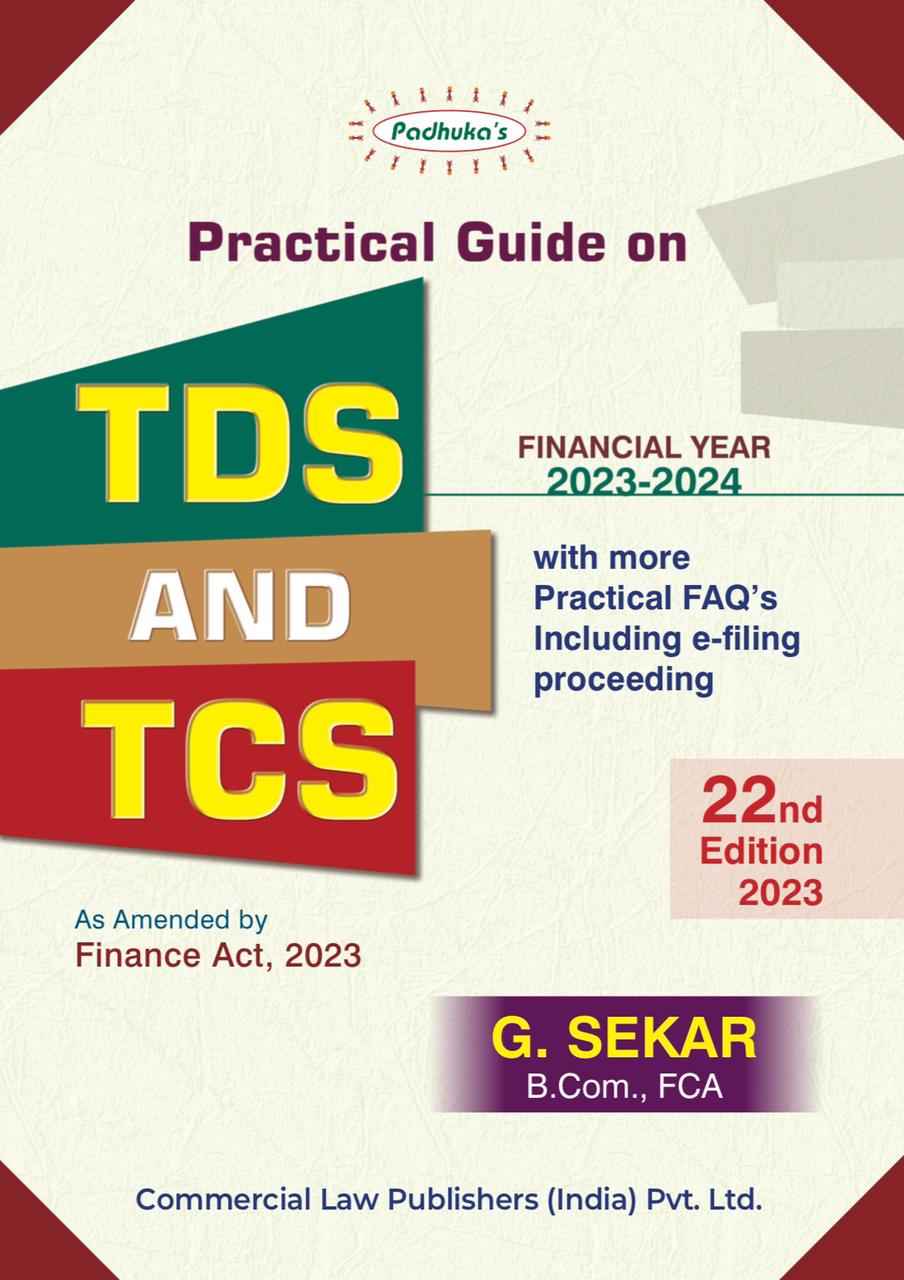

Commercial Padhuka Practical Guide on TDS and TCS By G. Sekar Edition April 2023

₹ 1,099 Original price was: ₹ 1,099.₹ 825Current price is: ₹ 825.

Commercial Padhuka Practical Guide on TDS and TCS By G. Sekar Edition April 2023

₹ 1,099 Original price was: ₹ 1,099.₹ 825Current price is: ₹ 825.

Concise presentation of the law relating to TDS and TCS. Ready Referencer for IDS and TCS rates clearly demarcating rates for various Assessees under different situations.

Commercial Practical Guide on TDS and TCS By G. Sekar

Commercial Practical Guide on TDS and TCS By G. Sekar

Highlights

- Concise presentation of the law relation to TDS and TCS.

- Ready Referencer for TDS and TCS rates clearly demarcating rates for various Assesses under different situations.

- Simplified, yet detailed and comprehensive procedures on how to compute income under the head Salaries and Income form House Property for determining TDS on Salaries. Coverage of Relief for VRS Compensation. Arrears of Salary, etc.

- All Latest Amendments, Circulars. Notifications included.

- Answers to various questions on TDS.

- Provisions and Procedure for TCS.

- Formalities and Procedure for e-TDS Return and e-TCS Returns.

- Summary of Provisions relating to Annual Information Return.

- Beneficiaries & Users of this Book include

- Office of the Comptroller and Auditor General of India.

- Office of the Central Board of Direct Taxes, Chief Commissioners of Income-Tax for use by the Officers of TDS Wing, as well as DDOs.

- National Academy of Direct Taxes, Ministry of Finance. Nagpur

- Various Nationalized Banks like Indian Bank. State Bank of India. Canara Bank, Corporation Bank etc. for use at their Branches.

- Various Companies and Firms in the Manufacturing and Service Sector.

- Accounting, finance. Investment & Legal Professionals- in practices & service.

About the Author

G. Sekar completed his B.Sc. Chemistry in Dharmapuri Arts College (University of Madras; 1993) and M.Sc. Organic Chemistry in Department of Organic Chemistry, Guindy Campus, University of Madras (1995; M.Sc. thesis guide: Prof. P. Rajakumar).He obtained his PhD in synthetic organic chemistry from Indian Institute of Technology Kanpur in 1999 under the guidance of Padma Shri Prof. V. K. Singh. He has carried out his JSPS postdoctoral fellowship at Toyohashi University of Technology, Japan (with Prof. H. Nishiyama; Apr. 2000 Jun. 2001), AvH postdoctoral fellowship at University of Goettingen, Germany (with Prof. L. F. Tietze; Jul. 2001 Dec. 2002) and senior postdoctoral fellowship at Caltech, USA (with Prof. Brian M. Stoltz; Feb. 2003 Dec. 2004), prior to joining IIT Madras in December 2004 where he is presently holding Professor position

His research interests lie in the areas of asymmetric synthesis, total synthesis of biologically active natural products, and synthesis and application of chiral nanocatalysts.

| Weight | 0.582 kg |

|---|---|

| bookauthor | |

| binding | |

| edition | |

| hsn | |

| isbn | |

| language | |

| publisher |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.