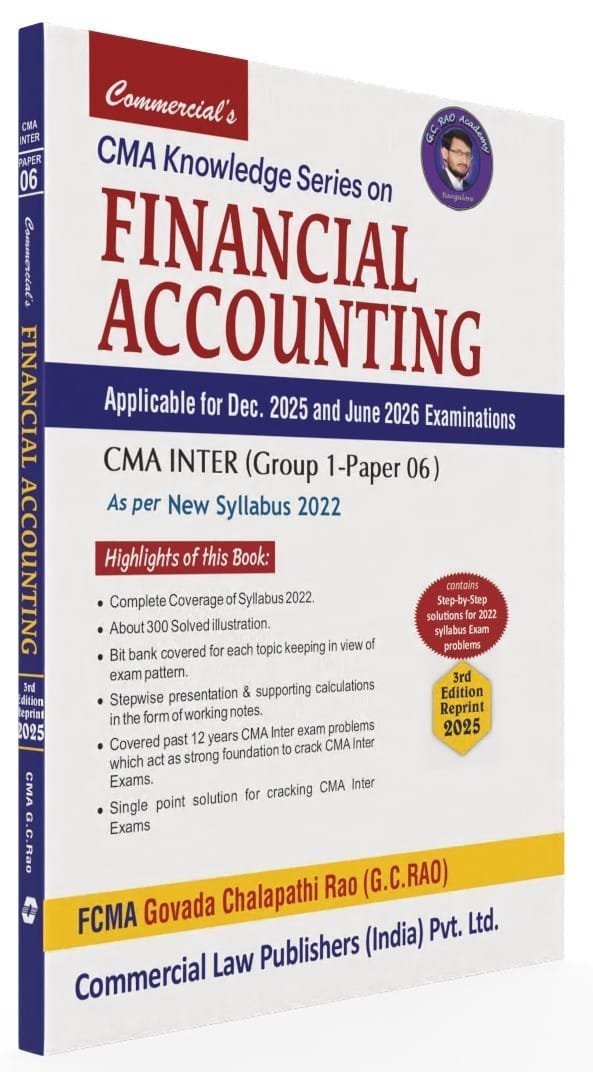

Commercial CMA Inter Financial Accounting By G.C. Rao for Dec 25 & June 26 Exam

CMA Knowledge Series on Financial Accounting (Group 1 Paper 6) New Syllabus

Salient features of the book are-

- Each topic is covered in a pattern relevant for CMA Online examinations

- Introduction of Concept

- Multiple Choice Questions (MCQ)

- Fill in the blanks

- True or False

- Descriptive questions

- All Concepts explained in a simple and understandable manner.

- All past Institute of Cost Accountants of India exam questions covered

- Complete step by step solutions for 2022 syllabus exam problems

- Full coverage of 2022 syllabus prescribed for CMA Inter Group 1 – Paper 06

Content

- SECTION A-Accounting Fundamentals

- Fundamentals of Accounting

- Unit 1.1-Accounting Fundamentals

- Unit 1.2-Accounting Concepts & Conventions

- Unit 1.3-Capital & Revenue Transaction

- Unit 1.4-Basic Terms in Accounting

- Unit 1.5-Double Entry System

- Unit 1.6-Journal and Ledger

- Unit 1.7-Rectification of Errors

- Bit Bank

- Accounting for Depreciation

- Bank Reconciliation Statement

- SECTION B-Accounting for Special Transactions

- Bills of Exchange

- Consignment Accounting

- Joint Venture Accounting

- SECTION C-Preparation of Financial Statements

- Preparation of Final Accounts of Commercial Organizations

- Preparation of Final Accounts of Not for Profit Organisations

- Preparation of Financial Statements from Incomplete Records

- SECTION D-Partnership Accounting

- Partnership

- Unit 10.1-Admission of a Partner

- Unit 10.2 Retirement of a Partner

- Unit 10.3-Death of a Partner

- Unit 10.4-Dissolution of Firm & Insolvency of a Partner

- Unit 10.5-Piecemeal Distribution

- Unit 10.6-Amalgamation of Firm & Conversion

- Unit 10.7-Accounting of Limited Liability Partnership

- Bit Bank

- SECTION E-Lease, Branch and Departmental Accounts

- Lease Accounting

- Branch Accounts

- Insurance Claims for Loss of Stock & Loss of Profit

- Hire Purchase & Installment Purchase System

- SECTION F-Accounting Standards

- Accounting Standards

- 2022 Syllabus Exam Bits

About the Author

- Govada Chalapathi Rao (G.C.Rao) is a graduate in commerce and a fellow member of the Institute of Cost Accountants of India. He secured All India 12th Rank in CMA Inter and 16th Rank in CMA Final.

- He possesses 15 years of teaching experience to students of CMA Foundation, Inter and Final.

- He is faculty member at G.C.RAO ACADEMY, an exclusive coaching center for CMA. He is visiting faculty at Institute of Chartered Accountants of India, Bangalore chapter.

- Areas of specialization include Cost Accounting, Strategic Cost Management, Financial Accounting, Direct Taxation, Financial Management, Indirect Taxation, Financial Reporting, and Cost Audit.

| Weight | 1.00 kg |

|---|---|

| bookauthor | G.C. RAO |

| binding | Paper back |

| edition | 2025 Edition |

| hsn | 49011010 |

| isbn | 9789349957251 |

| publisher | Commercial Publications |

Related products

Original price was: ₹670.₹510Current price is: ₹510.