No products in the cart.

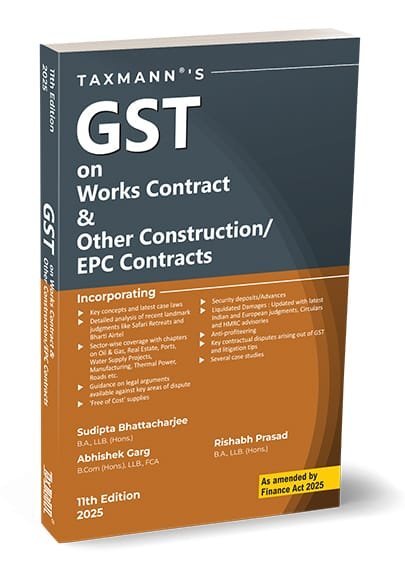

Return To ShopTaxmann GST Works Contract Other Construction Sudipta Bhattacharjee

Taxmann GST Works Contract Other Construction Sudipta Bhattacharjee

Description

This comprehensive treatise offers a complete analysis of the implications of the Goods and Services Tax (GST) on works contracts and construction and EPC (Engineering, Procurement & Construction) contracts. The book simplifies the intricacies of GST law, providing sector-specific insights for areas such as oil & gas, real estate, manufacturing, thermal power, roads, ports, and water supply projects. Incorporating a wealth of case studies, practical examples, and landmark judgments simplifies the complexities surrounding liquidated damages, security deposits/advances, anti-profiteering, valuation, etc. It also discusses litigation strategies, helping professionals anticipate and manage potential disputes.

This book is intended for the following audience:

- Tax Practitioners & Consultants – For expert guidance on GST-related nuances of works contracts

- Lawyers & Legal Professionals – For in-depth legal analysis and recent judicial precedents concerning contract disputes under GST

- Builders, EPC Contractors & Real Estate Developers – For clarity on complex compliance requirements, input tax credit mechanisms, and tax-saving strategies

- Finance & Accounting Professionals – For insights into time of supply, invoice issuance, and valuation in works contracts

- Corporate & Project Managers – For a practical understanding of GST in ongoing and upcoming infrastructure, construction, and EPC projects

The Present Publication is the 11th Edition | 2025 and has been amended by the Finance Act 2025. It is authored by Sudipta Bhattacharjee, Rishabh Prasad & Abhishek Garg, with the following noteworthy features:

- [Finance Act 2025 Amendments] Incorporates and clarifies the latest changes introduced by the Finance Act 2025, ensuring readers have up-to-date information on GST laws

- [Comprehensive Coverage & Comparative Insights] Detailed exploration of the definition, scope, and classification of works contracts under GST with references to pre-GST regimes and international VAT/GST practices

- [Latest Case Laws & Landmark Judgments] Features analysis of crucial judgments, including those on Safari Retreats, Bharti Airtel, and European case references. It also discusses HMRC advisories and their relevance to the Indian context

- [Sector-wise Chapters] Detailed coverage of GST implications in Oil & Gas, Real Estate, Roads, Ports, Thermal Power, Water Supply, and Manufacturing projects

- [Deep Dive into Disputes & Litigation Tips] Explores key contractual disputes, anti-profiteering issues, liquidated damages, security deposits, and ‘free of cost’ supplies under GST. It also provides guidance on legal arguments for handling controversies

- [Practical Case Studies & Examples] Contains numerous scenarios illustrating how to classify a contract, optimise tax credits, and manage compliance obligations

- [User-friendly Approach] Features step-by-step explanations, flowcharts, and checklists, making the GST ecosystem accessible even to non-tax professionals

The coverage of the book is as follows:

- Fundamentals of GST & Its Applicability

- Introduction to the scheme and evolution of works contracts pre- and post-GST

- Core Definitions & Concepts

- Detailed understanding of the term’ works contract’ and what constitutes ‘immovable property’ and ‘transfer of property in goods’

- Composite & Mixed Supplies

- Guidance on differentiating composite contracts from mixed supplies, ensuring correct classification under GST.

- Time of Supply, Valuation & Input Tax Credit

- Points of taxation, procedures for invoicing, and treatment of advances/security deposits

- Valuation principles, including provisions around ‘free of cost’ supplies and liquidated damages

- Place of Supply & TDS Provisions

- Comprehensive coverage of place of supply rules, vital for cross-border/ inter-state works contracts

- Explanation of TDS mechanisms under GST for works contracts

- Sector-Specific Analysis

- Separate chapters focusing on real estate, roads, thermal power, ports, oil & gas, large manufacturing plants, and solar power projects

- Anti-Profiteering & Dispute Management

- Commentary on anti-profiteering measures and strategies to handle investigations and litigations

- Practical strategies for tax controversy management, including best practices on drafting and structuring works contracts

- Transitions & Comparisons

- Special discussion on the transition from pre-GST to GST regime and practical tips to handle legacy contract disputes

- Comparative insights with Middle-East VAT regimes to help multinational businesses

The structure of the book is as follows:

- Introductory Chapters – Set the stage with an overview of GST, including historical context, the evolution of works contract laws, and the significance of the Finance Act 2025

- Definitional & Conceptual Chapters – Focus on core definitions like immovable property, transfer of property, and composite vs. mixed supply

- Applicability & Compliance – Chapters dedicated to registration, invoicing, time of supply, valuation, place of supply rules, and TDS under GST

- Practical Insights & Case Studies – Examples illustrate crucial concepts such as free-of-cost supplies, liquidated damages, security deposits, and dispute-resolution strategies

- Sectoral/Industry-Focused Chapters – Each major sector—Real Estate, Oil & Gas, Ports, Thermal Power, Solar Power, etc.—has its chapter exploring specific concerns and solutions

- Advanced Topics & Strategic Guidance – Addresses more nuanced issues such as anti-profiteering, best practices for contract structuring, and offshore supply tax controversies

- Supplementary Materials – Annexures with rate schedules, relevant notifications, and guidelines for quick reference

About the Author

Sudipta Bhattacharjee:

Sudipta is a Partner at a reputed law firm based out of Delhi and has more than 12 years of experience in providing strategic tax and allied commercial-legal advisory services to clients in diverse sectors and in structuring, drafting, reviewing, and negotiation of various contracts. He is a lawyer by qualification, and has graduated from the prestigious National University of Juridical Sciences, Kolkata.

Sudipta specializes in all pre-GST Indian indirect taxes including Customs, Excise, Service Tax as well as GST and contract documentation related services. He has been involved in providing strategic advice on the GST transition and implementation in India to businesses across sectors and has undertaken several training sessions educating clients and general public about the impact of GST on their key business processes. Sudipta has also led VAT impact assessments for business conglomerates in Kuwait relating to the proposed VAT introduction in middle-east (Gulf Cooperation Council countries).

Sudipta has written extensively on GST and other tax issues in newspapers like Business Stan

Rishabh Prasad

Abhishek Garg

| Weight | 0.5 kg |

|---|---|

| bookauthor | Abhishek Garg, Rishabh Prasad, Sudipta Bhattacharjee |

| binding | Paperback |

| edition | 11th Edition 2025 |

| hsn | 49011010 |

| isbn | 9789357782678 |

| language | English |

| publisher | Taxmann |

Only logged in customers who have purchased this product may leave a review.

Related products

Original price was: ₹1,245.₹930Current price is: ₹930.

Reviews

There are no reviews yet.