- Empty cart.

- Continue Shopping

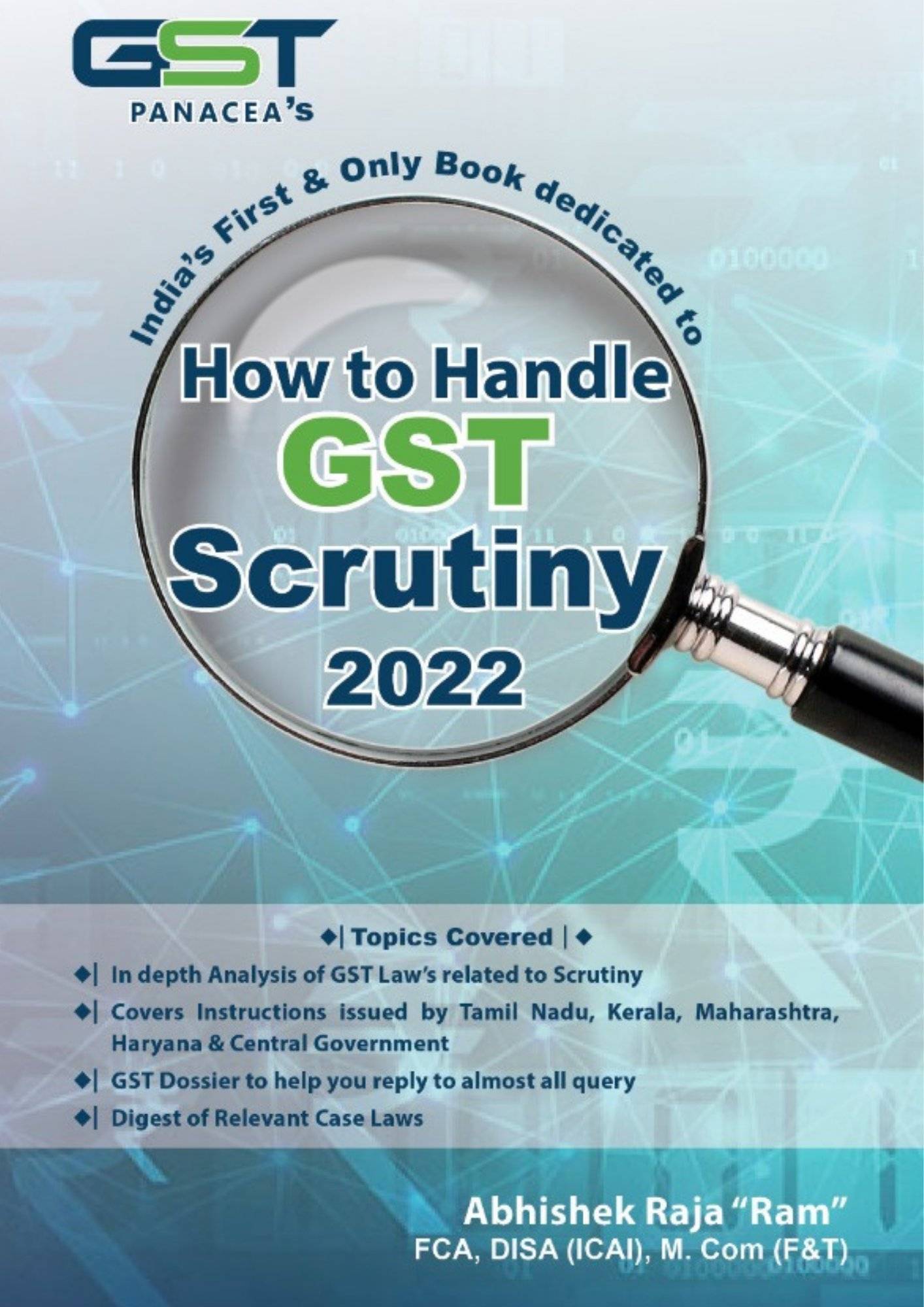

How to Handle GST Scrutiny By Abhishek Raja “Ram” Edition May 2022

₹ 1,249 Original price was: ₹ 1,249.₹ 1,000Current price is: ₹ 1,000.

Topics Covered

- In depth Analysis of GST Law’s related to Scrutiny

- Covers Instructions issued by Tamil Nadu, Kerala, Maharashtra, Haryana & Central Government

- GST Dossier to help you reply to almost all query

- Digest of Relevant Case Laws

Out of stock

Topics Covered

- In depth Analysis of GST Law’s related to Scrutiny

- Covers Instructions issued by Tamil Nadu, Kerala, Maharashtra, Haryana & Central Government

- GST Dossier to help you reply to almost all query

- Digest of Relevant Case Laws

Content

Chapter 1 Assessment..

- Annexure 1 – Standard Operating Procedure (Sop) For Scrutiny Of Returns For FY 2017-18 And 2018-19

- Annexure 2 – TNGST Act,2017- Standard Operating Procedure For Scrutiny For Returns Refund – Certain Guidelines Issued Instructions -Issued

- Annexure 3 – Instructions/Guidelines Regarding Procedure To Be Followed In Scrutiny Of Returns And Thenceforth Actions

- Annexure 4 – Proper Officer Functions – Scrutiny, Assessment Detention, Seizure, Release And Refund

- Annexure 5 – Guidelines With Respect To Scrutiny Parameter And System Or Data Related Issues Faced During Return Scrutiny Under GST

- Annexure 6 – Haryana GST Returns Scrutiny Manual

- Annexure 7 – Issuance Of SCNS In Time Bound Manner-Regarding

- Annexure 8 – Form GST ASMT -10

- Annexure 9 – Form GST ASMT-11

- Annexure 10 – Form GST ASMT-12

- Annexure 11 – Form GST DRC- O3

- Annexure 12 – Form GST DRC-04

- Annexure 13 –Press Release

Chapter 2 Officers under GST

Chapter 3 Demands and Recovery

Chapter 4 GST Scrutiny Decoded

- Annexure 1 – GST Procedure Related To Demands And Recover

- Annexure 2 – CAN GST Officers Directly Visit Your Premises To Collect GST Without Notice?

- Annexure 3 – Introduction To Checklist Of GST Scrutiny

- Annexure 4 – Selected Important Case Laws .

- Annexure 5 – M/S New Nalbandh Traders Versus State Of Gujarat &2 Other(S)

Chapter 5 Digest of Import GST Provisions

Chapter 6 Role of Tax Professional in GST

Chapter 7 GST Scrutiny Dossier

About the Author

CA.Abhishek Raja is a Fellow member of ICAl .and a hold Master’s Degree in Commerce. He had been a “Special Invitee” to “GST and Indirect Taxes Committee of ICAI” for year 2021-22. He has recently won Special Jury Award under the category FISCAL JOURNALISTS / COLUMNISTS by Tax India Online (TIOL Awards’ 2021). He has completed “Diploma in Information Systems Audit” (DISA) from ICAI. He has also successfully completed” Certification Course on Valuation” and “Certificate Course on Indirect Taxes” from ICAl. He has recently completed “Certificate Course on GST” from ICAl. He was Deputy Convenor for NIRC VAT Research Study Group for year 2012. He was a member for NIRC Company Law Research Study Group for yeat 2014. He was also visiting faculty with NIRC-ICAI for their Orientation Programmes & GMCS. His articles have been published in various magazines & newspapers. He has been panellist to reply queries on various magazines. He has also been panellist on discussions of GST on All India Radio (AIR-FM) and Television Channels. He is also speaker on VAT, Service Tax and GST and deliberated many Seminars. YUYUUUYUU queries on various magazines. He has also been panellist on discussions of GST on All India Radio (AIR-FM) and Television Channels. He is also speaker on VAT, Service Tax and GST and deliberated many seminars.

| Weight | 0.560 kg |

|---|---|

| bookauthor | |

| binding | |

| edition | |

| hsn | |

| isbn | |

| language | |

| publisher |