- Empty cart.

- Continue Shopping

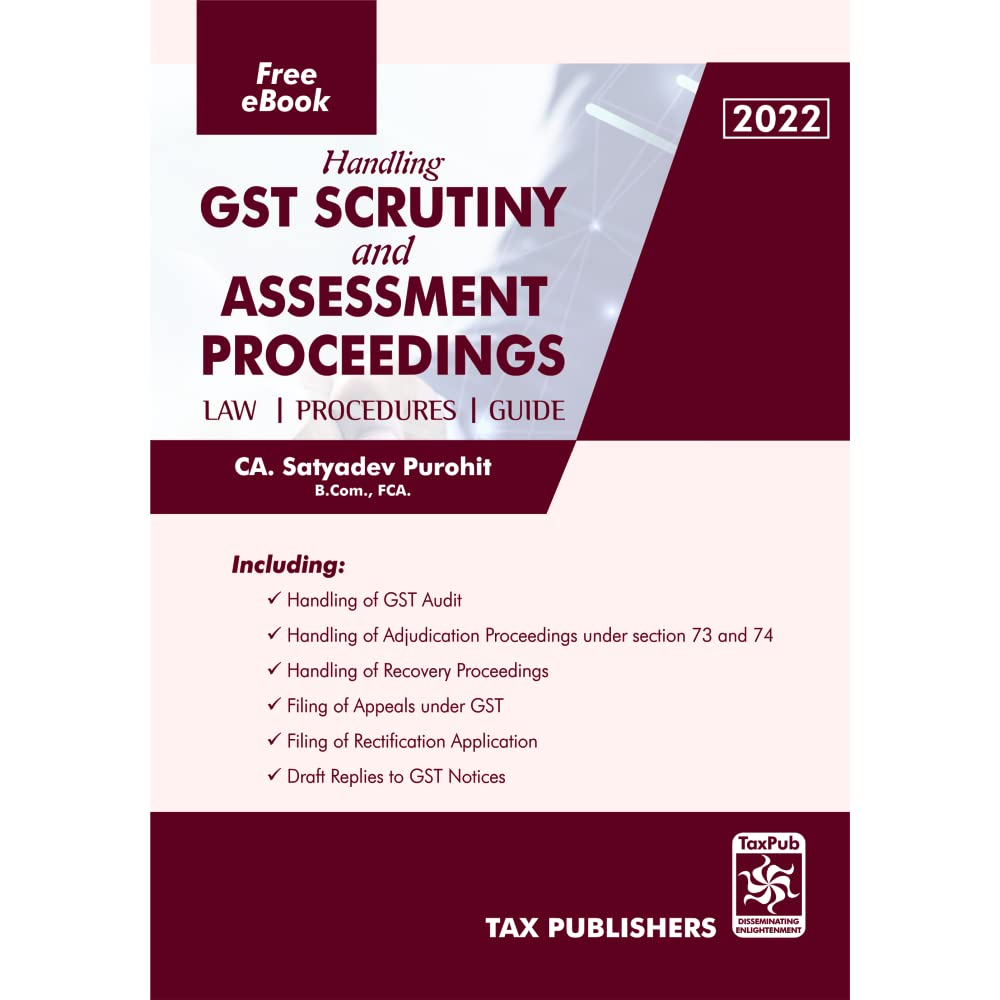

Tax Publisher Handling GST Scrutiny And Assessment Proceedings By CA. Satyadev Purohit Edition 2022

₹ 1,080 Original price was: ₹ 1,080.₹ 865Current price is: ₹ 865.

Tax Publisher Handling GST Scrutiny And Assessment Proceedings By CA. Satyadev Purohit Edition 2022

₹ 1,080 Original price was: ₹ 1,080.₹ 865Current price is: ₹ 865.

Handling GST Scrutiny And Assessment Proceedings

Handling GST Scrutiny And Assessment Proceedings

A Rigorous and Comprehensive Guide on Handling of: Notices Issued for Scrutiny of Returns Assessment/Adjudicating Proceedings Departmental Audit Rectification and remand Proceedings Provisional attachment of Bank Account for Recovery of Tax Law and Procedure on Filing Appeal to appellate Authority and Higher Appellate Forum Detailed discussion on Various Parameters for Selection of Returns for Scrutiny with suggested Strategy to be followed by Taxpayers on Various Issues Full Text of Relevant Circulars, Instructions, Trade Notices and Forms Reproduced in Appendix to the Relevant Chapter for Instant Reference Separate Part Comprising select Draft Replies to GST Notices on Concurrent Issues Ratio of Landmark Judicial Pronouncements Incorporated at Relevant Places Indispensable for Chartered Accountants, Tax Consultants and GST Practitioners Updated by Latest Circulars and Notifications and GST Council Recommendations

| Weight | 0.640 kg |

|---|---|

| bookauthor | |

| binding | |

| edition | |

| hsn | |

| isbn | |

| language | |

| publisher |