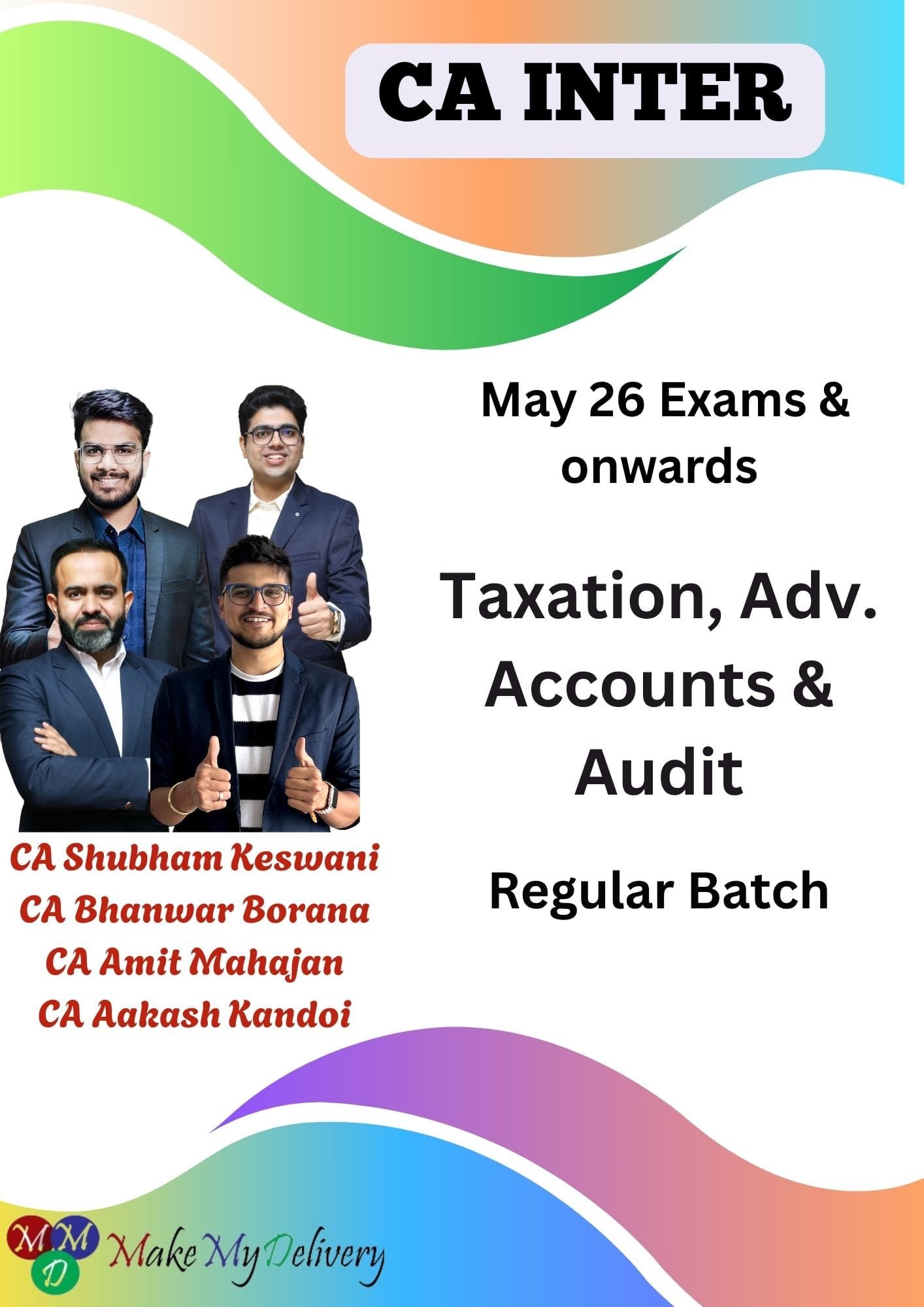

Taxation, Adv. Accounts & Audit Bhanwar Borana Jan 26 Exam

Taxation, Adv. Accounts & Audit Bhanwar Borana Jan 26 Exam

Audit

Language – Hindi – English Mix

No. of Lectures – 65 Lectures (approx)

Duration – 150 Hours

Validity – 1 Year from the Date of Activation

View – 1.7 View

Study Material

Notes & Question Bank hardcopy

Adv. Accounting

No of Lectures – 95 Approx.

Duration – 230 hours Approx.

Validity – 1 Year from the date of Activation.

Views – 1.7 Views

Study Material

2 Q&A Book

1 MCQ Book

(Concept Notes will be Handwritten in Class Itself for Best Understanding)

Direct Tax

No of Lectures – 58 Lectures Approx

Duration – 175 hours Approx

Views – 1.5 Times

Validty – 1 Year from the date of activation

Study Material

1 Compact Theory Book

1 Compact Q&A Book & MCQ (Softcopy)

GST

No. of Lectures – 35 – 40 Lectures Approx.

Duration – 115 Hours Approx

Validity – 1 Year from the Date of Activation

View – 1.5 views

Study Material

1 Rapider (Study Material)

1 Q&A Book

1 Pocket Book

(Concept Notes will be Handwritten in Class Itself for Best Understanding)

Faculty Info

CA Bhanwar Borana

Founder of BB Virtuals, given 300+ ranks in CA and gives regular lectures at ICAI and various taxation platforms with 10 years of teaching experience in IPCC and Final Direct and International Taxation exams.

CA Amit Mahajan

A Chartered Accountant and LLB from Mumbai, having 6 years of practical experience in corporate tax at one of the Big4 (EY), I took a step towards my passion of teaching Taxation and Law. He has have been teaching students across the streams of CA, CS, CMA for over the 5 years now. Taxation being a complex subject, I make the most of my corporate life experience to take you through practical scenarios.

CA Aakash Kandoi

CA Aakash Kandoi is a qualified professional with CA, Dip IFS (ACCA, UK). He is a passionate professor with more than four years of teaching experience in the CA Foundation, CA Inter, and CA Final levels. He has expertise in conceptual teaching and strives to bring out the best of knowledge in his students. His zeal for education is based on his quote “Application of knowledge is more important than having it” which shows his focus on applying knowledge in order to achieve the desired results.

CA Shubham Keswani

CA Shubham Keswani is a Merit holder at CA Final & Inter level. He completed his 3 years of Articleship training in the field of Audit & Assurance from EY. Having secured exemption in Auditing at both levels of his CA Journey, his purpose is to enlighten you with his experience & expertise.

| Faculty Name | CA Aakash Kandoi, CA Amit Mahajan, CA Bhanwar Borana, Shubham Keswani |

|---|---|

| Course Name | CA Inter |

| Classes/Brand Name | CA Bhanwar Borana |

| Applicability | May 2026 |

| Language | Hindi – English Mix |

Related products

Original price was: ₹30,500.₹28,975Current price is: ₹28,975.