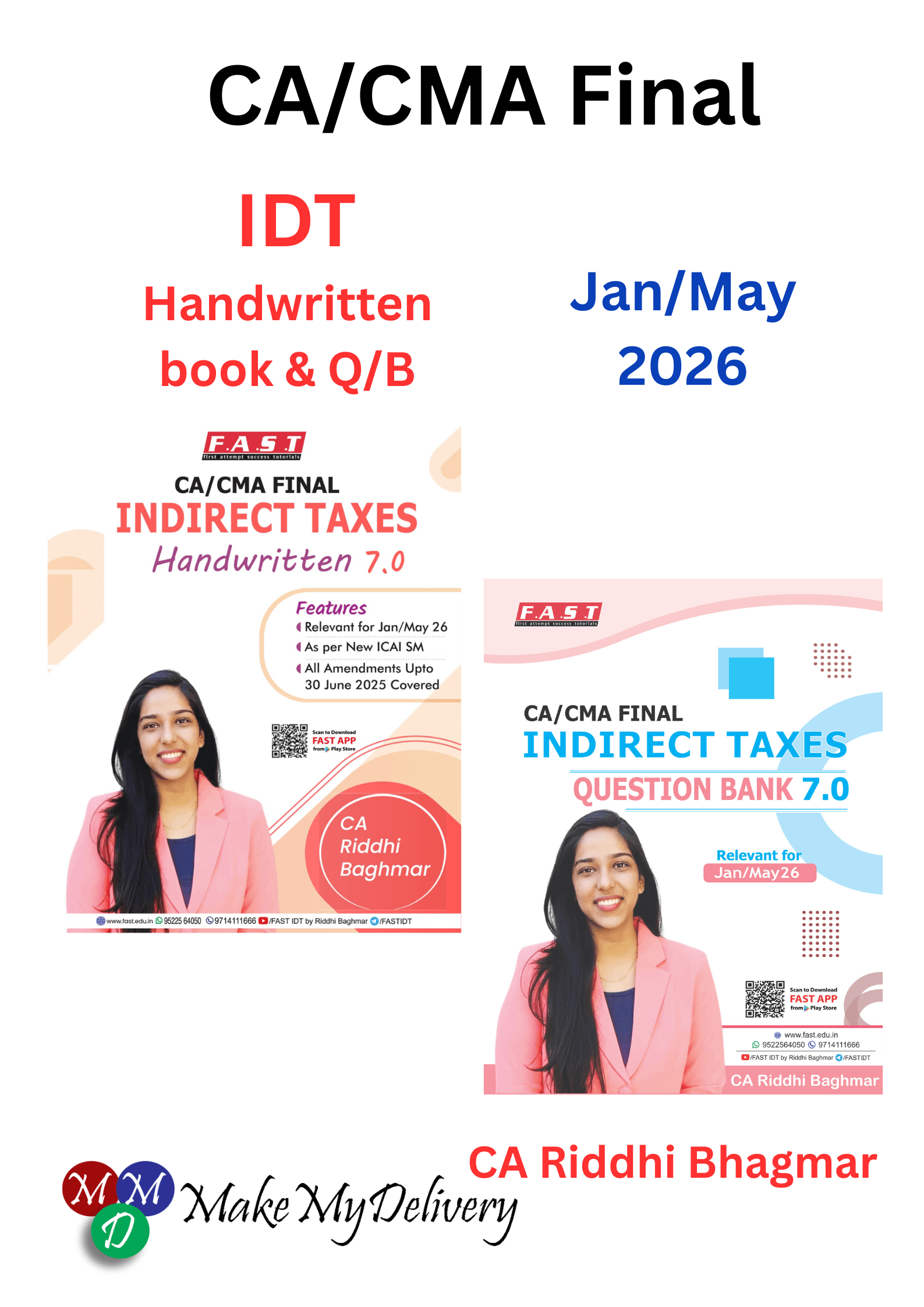

CA Final IDT Handwritten & Question Book CA Riddhi Baghmar Jan/May 26 Exams

CA Final IDT Handwritten & Question Book CA Riddhi Baghmar Jan/May 26 Exams

IDT Handwritten Concept book

PART – A GST

1A GST in India -An Introduction

1B Important Terms

1C Supply under GST

1D Composite and Mixed supply

2A Charge of GST

2B Composition Levy

3 Registration

4 Tax Invoice, Credit and Debit Notes

5 Time of supply

6 Value of supply

7 Place of supply

8 Exemption from GST

9A Input Tax Credit

9B Input service Distributor

10A Payment of Tax

10B TDS

11 E-commerce Transactions and TCS

12A Accounts and Records

12B E-way will

13 Returns under GST

14 Job Work

15 Assessment and Audit

16 Inspection, Search, Seizure and Arrest

17 Demands and Recovery

18 Liability to Pay in Certain Cases

19 Offences and Penalties

20 Appeals and Revision

21 Advance Ruling

22A Imports under GST

22B Exports under GST

23 Refunds under GST

24 Miscellaneous Provisions

25 Ethical Aspects under GST

PART – B CUSTOMS

1 Important Terms

2 Levy and Exemption

3 Importation and Exportation of Goods

4 Transit and Transhipment

5 Classification of Goods

6 Types of Duty

7 Valuation Under the Customs Act, 1962 350

8 Post Articles / Stores

9 Baggage

10 Warehousing

11 Refund

12 Foreign Trade Policy

IDT Question Bank book

PART 1: Goods And Service Tax

1 SUPPLY UNDER GST

2 CHARGE OF GST

3 PLACE OF SUPPLY

4 EXEMPTIONS FROM GST

5 TIME OF SUPPLY

6 VALUE OF SUPPLY

7 INPUT TAX CREDIT

8 REGISTRATION

9 TAX INVOICE; CREDIT AND DEBIT NOTES

10 ACCOUNTS AND RECORDS; E-WAY BILL

11 PAYMENT OF TAX

12 ELECTRONIC COMMERCE TRANSACTIONS UNDER GST

13 RETURNS

14 IMPORT AND EXPORT UNDER GST

15 REFUNDS

16 JOB WORK

17 ASSESSMENT AND AUDIT

18 INSPECTION, SEARCH, SEIZURE AND ARREST

19 DEMANDS AND RECOVERY

20 LIABILITY TO PAY IN CERTAIN CASES

21 OFFENCES AND PENALTIES AND ETHICAL ASPECTS UNDER GST

22 APPEALS AND REVISION

23 ADVANCE RULING

24 MISCELLANEOUS PROVISIONS

PART 2: Customs and FTP

1 LEVY OF AND EXEMPTIONS FROM CUSTOM DUTY

2 TYPES OF DUTY

3 CLASSIFICATION OF IMPORTED AND EXPORT GOODS

4 VALUATION UNDER THE CUSTOMS ACT, 1962

5 IMPORTATION, EXPORTATION AND TRANSPORTATION OF GOODS

6 WAREHOUSING

7 REFUND

8 FOREIGN TRADE POLICY

CA Riddhi Baghmar is a Chartered Accountant who has cleared all levels in first attempt, teaching IDT at CA Final. She has also passed all levels of CFA and is a gold medalist in Bcom. Radiant teaching style and fun tricks make her classes interesting.

| Weight | 0.001 kg |

|---|---|

| Book Author | CA Riddhi Baghmar |

| Binding | Paperback |

| Edition | Latest |

| HSN | 49011010 |

| Language | English |

| Classes/Brand Name | FAST EDUCATION |

| Applicability | Jan 2026 Exam |

Only logged in customers who have purchased this product may leave a review.

Related products

From: ₹590

Reviews

There are no reviews yet.