CA Final IDT Q/A Clarity By CA Siddhesh Valimbe

CA Final IDT Q/A Clarity By CA Siddhesh Valimbe

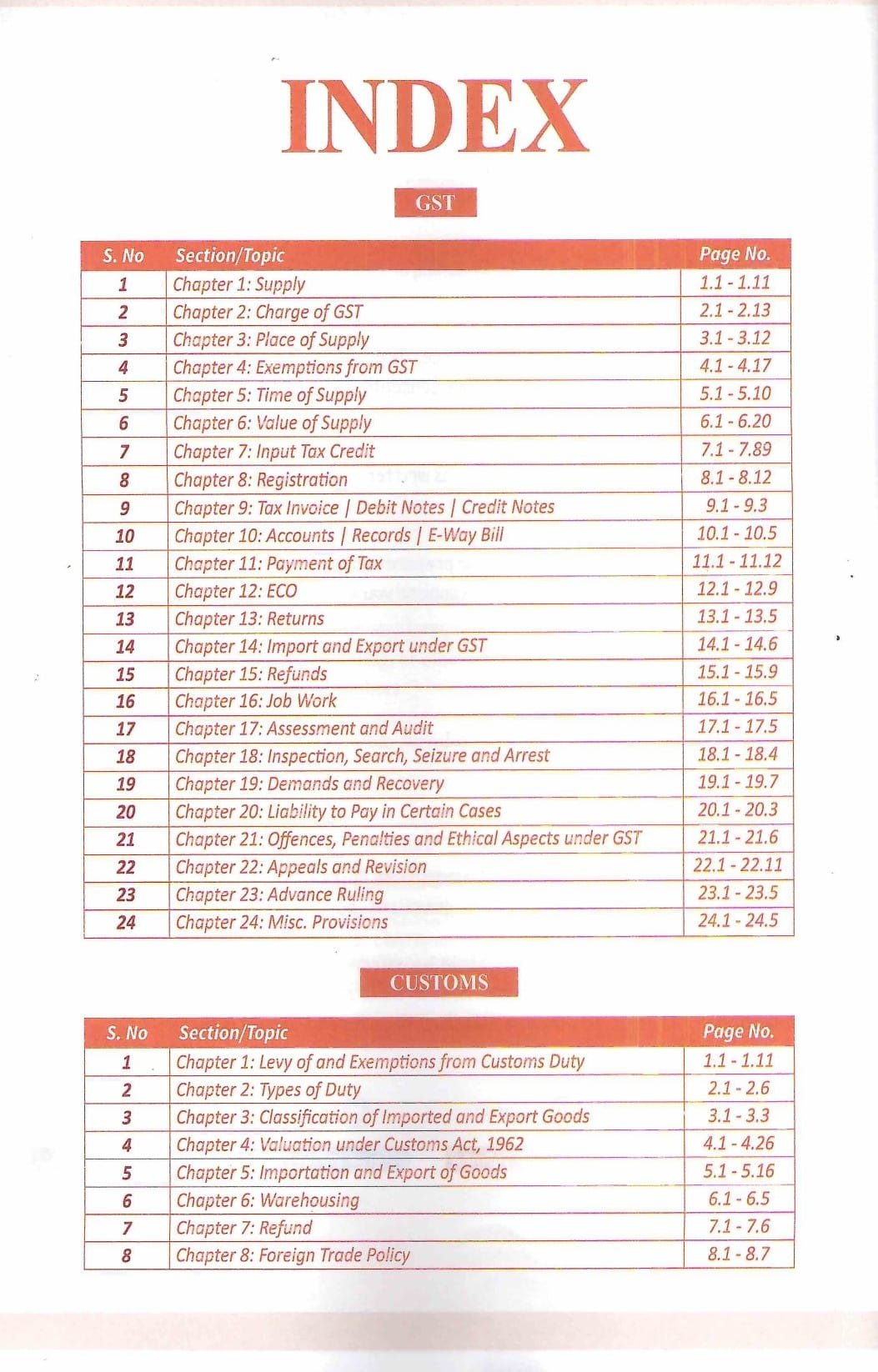

Chapters –

GST

- Supply

- Charge of GST

- Place of Supply

- Exemptions from GST

- Time of Supply

- Value of Supply

- Input Tax Credit

- Registration

- Tax Invoice / Debit Notes / Credit Notes

- Accounts / Records / E-Way Bill

- Payment of Tax

- ECO

- Returns

- Import and Export under GST

- Refunds

- Job Work

- Assessment and Audit

- Inspection, Search, Seizure and Arrest

- Demands and Recovery

- Liability to Pay in Certain Cases

- Offences, Penalties and Ethical Aspects under GST

- Appeals and Revision

- Advance Ruling

- Misc. Provisions

Customs

- Levy of and Exemptions from Customs Duty

- Types of Duty

- Classification of Imported and Exported Goods

- Valuation under Customs Act, 1962

- Importation and Export of Goods

- Warehousing

- Refund

- Foreign Trade Policy

About the Author

CA Siddhesh Valimbe

cleared his CA in 2019 in the First Attempt with an All India Rank 26th in the CA Final. He has always been passionate about teaching and had started taking classes even before the declaration of CA Final Results! He has been teaching Law and GST to CA, CS, and CMA Students since past 5+ years.

| Weight | 0.001 kg |

|---|---|

| bookauthor | CA Siddhesh Valimbe |

| binding | Paper back |

| edition | Latest |

| hsn | 49011010 |

| language | English |

| publisher | CA Bhanwar Borana |

Only logged in customers who have purchased this product may leave a review.

Related products

₹597

Reviews

There are no reviews yet.