- Empty cart.

- Continue Shopping

Bloomsbury The Comprehensive GST Tariff By Puneet Agrawal and Vipan Aggarwal Edition October 2022

0

₹ 2,999 Original price was: ₹ 2,999.₹ 2,250Current price is: ₹ 2,250.

Bloomsbury The Comprehensive GST Tariff By Puneet Agrawal and Vipan Aggarwal Edition October 2022

₹ 2,999 Original price was: ₹ 2,999.₹ 2,250Current price is: ₹ 2,250.

Bloomsbury The Comprehensive GST Tariff By Puneet Agrawal

Bloomsbury The Comprehensive GST Tariff By Puneet Agrawal

Highlights

- Upto-date text of CGST/IGST/Compensation Cess Rate notifications with complete history notes

- Guidance on how to classify and determine rate of tax

- Alphabetical and HSN wise commodity index

- User friendly tables

- CBIC circulars pertaining to GST Rate/classification

The book consists of 6 Parts as follows:

Part-1: Introduction

- General Principles of Classification

- Principles of classification of goods and services

- Bird’s eye view of Rate Notifications issued under GST

Part-2: Commodity index

- Customs Tariff-wise list of goods

- Service code-wise list of taxable services

- Alphabetical list of goods

Part-3: CGST-Rate Notifications

- CGST Rate Notifications with Table of Subject-wise CGST Rate notifications

- Explanatory notes for classification of services under GST

Part-4: IGST-Rate Notifications with Table of Subject-wise IGST Rate notifications

Part-5: Compensation Cess-Rate Notifications with Table of Subject-wise

- Compensation Cess Rate notifications

Part-6: CBIC Circulars (for GST Rates/Classification issues) with Quick Reference

- Table (QRT) containing summary of circulars

About the Author

Puneet Agrawal has 16+ years of experience in providing tax and legal services, and is the founding partner of ALA Legal, a firm specializing in indirect tax litigation and

advisory services. He possesses extensive knowledge and strong command on the subject. Puneet has successfully handled and represented varied matters on indirect taxes (including GST, VAT, Service tax, Customs, Excise and other indirect taxes) and direct taxes. He has also represented highly contested corporate and insolvency and bankruptcy matters. Puneet has worked for multiple industry segments including Indian and foreign multinationals, PSUs and Fortune 500 companies.

Vipan Aggarwal is a Fellow member of The Institute of Chartered Accountants of India. He is engaged in providing professional services in the field of Indirect Taxes, Direct Taxes, International Taxation, Finance & IT Related services, Auditing, and Consultancy for more than 35 years.

| Weight | 1.5 kg |

|---|---|

| bookauthor | |

| binding | |

| edition | |

| hsn | |

| isbn | |

| language | |

| publisher |

Related products

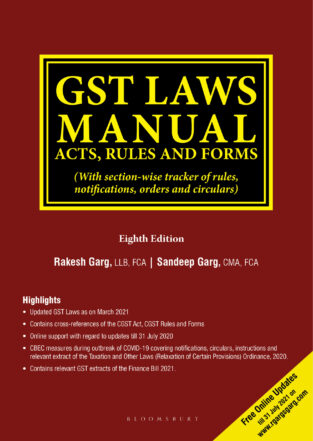

Bloomsbury GST Laws Manual Acts, Rules and Forms By Rakesh Garg , Sandeep Garg Edition April 2021

Rated 5.00 out of 5

1

Taxmann GST Tariff with GST Rate Reckoner (Set of 2 volumes) Edition March 2024

0

Bharat Compendium of Issues and Solutions in GST Exhaustive Commentary By Madhukar N Hiregange Edition August 2021

0

Taxmann Goods and Service Tax Ready Reckoner By V S Datey Edition March 2024

0

Commercial Loophole Games – A Treatise on Tax Avoidance Strategies By Smarak Swain Edition 2024

0

Commercial Special Economic Zones / EOUs / EHTPs & STPs Law & Practice Set of 2 Volumes By C.P Goyal ,O.P Arora ,A.K Sinha , Mayank Sharma Edition June 2023

0

Taxmann GST Case Laws Digest Edition March 2020

0