- Empty cart.

- Continue Shopping

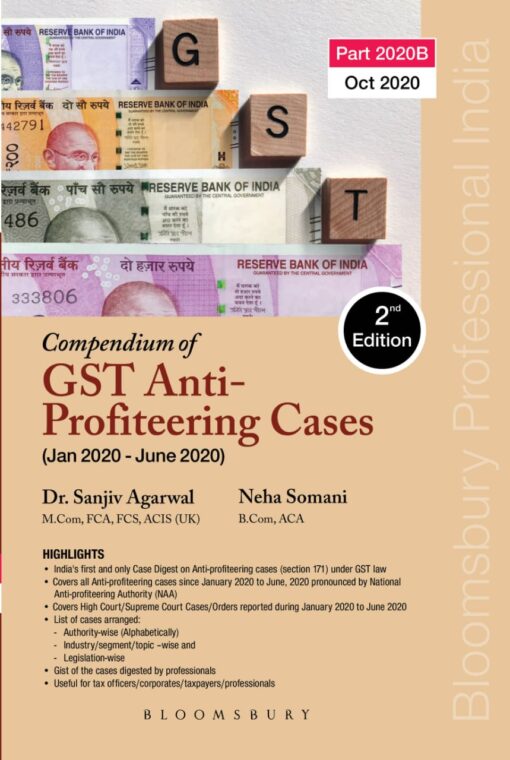

Bloomsbury Compendium of GST Anti-Profiteering Cases (Jan 2020 ? June 2020) By Sanjiv Agarwal and Neha Soman Edition October 2020

₹ 2,495 Original price was: ₹ 2,495.₹ 1,622Current price is: ₹ 1,622.

Bloomsbury Compendium of GST Anti-Profiteering Cases (Jan 2020 ? June 2020) By Sanjiv Agarwal and Neha Soman Edition October 2020

₹ 2,495 Original price was: ₹ 2,495.₹ 1,622Current price is: ₹ 1,622.

Covers all cases / orders on Anti-profiteering under GST law (section 171 of CGST Act, 2017 and Rules 122-137 of CGST Rules 2017).

Bloomsbury Compendium of GST Anti-Profiteering Cases Sanjiv Agarwal

Bloomsbury Compendium of GST Anti-Profiteering Cases Sanjiv Agarwal

Description

The present 2nd edition of this bi-annual publication of the book ? Compendium of GST Antiprofiteering Cases contains the gist / analysis and text of judicial pronouncements on Antiprofiteering provisions reported during 1st January, 2020 to 30th June, 2020 by National Antiprofiteering Authority (NAA) and courts.

While Chapter 1 and 2 contain statutory provisions of section 171 of the CGST Act and the relevant rules of CGST Rules on Anti-profiteering, Chapter 3 covers Anti-profiteering Orders pronounced by the NAA. Chapter 4 covers judgments pronounced by various High Courts and the Supreme Court reported upto 30th June, 2020.

The earlier cases /orders can be referred to in First edition of the book.

Key features

- Covers all cases / orders on Anti-profiteering under GST law (section 171 of CGST Act, 2017 and Rules 122-137 of CGST Rules 2017).

- Contains gist and full text of NAA orders / High Courts / Supreme Court judgments / Orders.

- All orders / cases u/s 171 since January 2020 ? July 2020 covered.

- All order / cases u/s 171 from inception to December 2019 can be referred to in first edition of Book (January 2020).

- Useful for tax officers, NAA, corporates / taxpayers / professionals.

- One point reference for all Anti-profiteering cases.

About the author

| Weight | 2 kg |

|---|---|

| bookauthor | |

| binding | |

| edition | |

| hsn | |

| isbn | |

| language | |

| publisher |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.