No products in the cart.

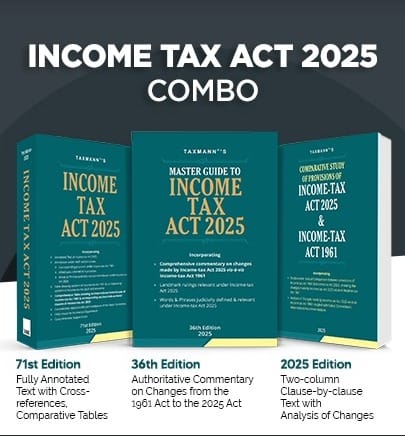

Return To ShopCombo Income Tax Act 2025 & Master Guide to Income Tax Act 2025 & Comparative Study of Provisions of Income Tax Act 2025 & Income Tax Act 1961 Set of 3 Books Edition 2025

Combo Income Tax Act 2025 & Master Guide to Income Tax Act 2025 & Comparative Study of Provisions of Income Tax Act 2025 & Income Tax Act 1961 Set of 3 Books Edition 2025

Description

The Income Tax Act 2025 COMBO brings together three complementary volumes, including:

- Income Tax Act 2025 (fully annotated with backwards mapping to the 1961 Act)

- Master Guide to Income Tax Act 2025 (authoritative commentary with judicial definitions and a landmark-rulings digest)

- Comparative Study of Provisions of the Income-tax Act 2025 & Income-tax Act 1961 (clause-by-clause, two-column comparison with analysis of changes, Select Committee notes, and Departmental FAQs)

These books embody Taxmann’s legacy—experience, speed, authenticity, and accuracy—to deliver a definitive, transition-ready reference for compliance, advisory, and litigation.

This Combo is intended for the following audience:

- Tax Professionals & Law Firms needing section-wise guidance with quick cross-references to the 1961 Act

- Corporate Finance, Tax & Legal Teams(CFOs, Controllers, Heads of Tax) updating SOPs, ERPs, and compliance under the 2025 framework.

- Judiciary, Tribunals & Litigation Counselrequiring Notes on Clauses, Select Committee materials, and case-law digests mapped to the 2025 Act

- Academicians, Researchers & Advanced Studentsseeking structured learning with commentary, definitions, and comparative tables

- Policy Analysts & Lawmakersstudying the legislative migration and its practical implications

The Present Combo is a three-volume set, authored and edited by Taxmann’s Editorial Board, with the following noteworthy features:

- [End-to-end Transition Coverage] Text → Commentary → Comparative mapping for seamless navigation between 1961 and 2025 regimes

- [Backward & Reverse Mapping] Old‑to‑new and new‑to‑old tables; quick backwards mapping embedded

- [Judicially Defined Terms] An exhaustive dictionary mapped to the 2025 Act for precise interpretation

- [Landmark Rulings Digest] Supreme Court/High Court summaries arranged section-wise and alphabetically for quick recall.

- [Change Analytics] ‘Analysis of Changes’ after each mapped provision with practical implications

- [Legislative & Departmental Context] Consolidated Select Committee observations and CBDT FAQs for rationale and implementation clarity

- [Research Efficiency] Heavy cross-references, visual signposts, and granular indexing across the set

- [Legacy Pillars] Built on Taxmann’s experience, speed, authenticity, accuracy—from sourcing to alignment

The coverage of each book is as follows:

- Income Tax Act 2025

- Complete, annotated textof the 2025 Act with clear explanations under each section

- Cross‑references to the 1961 Actfor ease of transition

- Allied laws are referencedwherever cited within the Act

- Judicially noticed words & phrasesrelevant to interpretation

- Comparative analysis tables(1961 ↔ 2025) and legislative insights (Select Committee)

- Departmental guidancevia FAQs issued by the Income‑tax Department (CBDT)

- Extensive subject index & appendicesfor targeted retrieval

- Master Guide to Income Tax Act 2025

- Comprehensive transition commentaryexplaining critical shifts from 1961 to 2025

- Judicially defined terms—an exhaustive, dictionary‑style compilation mapped to the 2025 Act

- Landmark rulings digest—Supreme Court/High Court summaries arranged section‑wise and alphabetically

- Cross‑reference tables and visual aids(tables/charts) for TDS, TCS, capital gains, NPO, etc.

- Division‑wise Emphasis

- Division I (200+ pages) – Concepts, basis of charge, five heads of income, presumptive regimes, depreciation, special rates, search & seizure, faceless schemes, assessments/returns/appeals, NPOs, penalties/prosecution, repeal & savings, TP clarifications

- Division II (300+ pages)– Judicial definitions (alphabetical + section‑wise) with authoritative citations

- Division III (600+ pages)– Landmark rulings digest curated for continuing precedential value under 2025

- Comparative Study of Provisions of Income Tax Act 2025 & Income Tax Act 1961

- Two-column, Clause‑by‑clause Comparison– 1961 on the left; 2025 on the right—aligned to sub‑section, clause, sub‑clause, item, proviso, and Explanation

- Precise Mark‑up of Changes

- 1961 Act – Bold+ strike‑through for deletions/modifications

- 2025 Act – Boldfor simplifications/new insertions

- Analysis of changes after each mapped provision with practical implications and drafting/litigation angles

- Embedded Institutional Context– Select Committee extracts and CBDT FAQs within the comparison

- Comprehensive cross‑mapping tables(35+ pages) for instant navigation

- ‘No‑corresponding‑section’ coverage for 2025 provisions with no 1961 parallel

- Editorial Pillars– Depth, speed, authenticity, accuracy

The structure of each book is as follows:

- Income Tax Act 2025 – Section-wise statute → annotation → corresponding 1961 provision(s) → allied-law references → judicially noticed terms → comparative tables → Select Committee & FAQs → subject index

- Master Guide to Income Tax Act 2025 – Division-based framework—Commentary → Judicial Definitions → Rulings Digest; each chapter opens with a quick-reference summary and is deeply cross-referenced

- Comparative Study of Provisions of Income Tax Act 2025 & Income Tax Act 1961– Two-column comparison between 1961 Act vs 2025 Act with visual signposts for insertions/deletions; per-item change analysis; no-counterpart 2025 provisions collated at the end

- Across the Combo– Dual mapping (old↔new), dictionary-style organisation for definitions, digest notes, and rich indexing for rapid research

- Recommended Usage Path

- Locate & Alignusing Comparative Study to identify corresponding provisions

- Read the Lawin the Income Tax Act 2025 (Annotated) for authoritative text and notes

- Deep‑dive & Applywith the Master Guide for commentary, judicial definitions and rulings

| Weight | 6.07 kg |

|---|---|

| Binding | Paperback |

| Book Author | Taxmann's Editorial Board |

| Edition | 2025 Edition |

| HSN | 49011010 |

| ISBN | 9789371267892, 9789371265850, 9789371265867 |

| Language | English |

| Publisher | Taxmann |

Only logged in customers who have purchased this product may leave a review.

Related products

Original price was: ₹8,585.₹5,835Current price is: ₹5,835.

Reviews

There are no reviews yet.